Is Tesla(TSLA) stock SEXY?

The pictures below is Tesla's line that released or will be release.

Every time a new Tesla model came out, consumers were enthusiastic. including me..

and Tesla's stock also went crazy.

Tesla Overview

Tesla's current Market Cap is 165B. ( Second in the automobile market , No.1 Toyota - 234B )

And Tesla has made its first profit in the last two quarters since 2012 when it started producing mass-produced cars.

reason why it was able to make profit was because unit cost of production decreased and sales increased due to mass-production of electic vehecles.

Tesla sold about 400,000 electric vehicles in 2019 alone and expects to produce and sell about 500,000 electric vehicles annually in 2020.

here is the question of Tesla's share price. Tesla is confident of producing 500,000 cars next year and expects to produce 2 million to 3 million electric vehicles in the next two to three years.

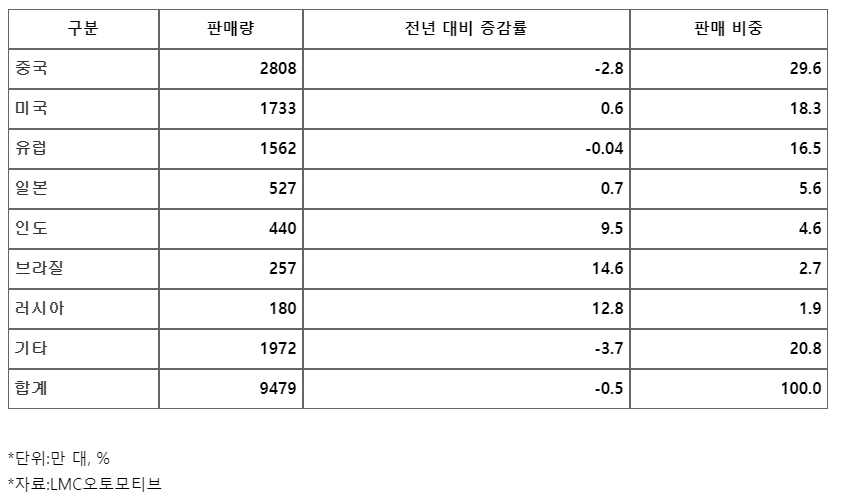

Though not the 2019 data, around 94 million cars are sold worldwide annually. and in 2019, Volkswagen, the largest automaker, sold around 6.25 million units a year.

Can Tesla continue to take the lead in the electric car market as Volkswagen, Toyota, Hyundai and other companies are now entering the electric car market? It may or may not, but i think Tesla's current share price is highly valued, considering the risk of global carmakers focusing on producing electric vehicles and catching up with Tesla.

I think Tesla needs to maintain two things to keep the current lead.

1) Maintain an advanced (innovative) image

Tesla started off with a supercar concept before it was mass-produced and now the cheapest Model 3 also gives something rare and cool. However, Tesla is currently targeting mass production. If you see a lot of Model 3 on the street, can Tesla give you the feeling that Tesla has now? I believe that it is difficult to take both high-end and mass-produce products at the same time, and that there is a high chance that supercar lines like Porsche will still take the premium line, as in the era of internal combustion engines. That's why Tesla's share price is now considered highly valued.

2) Maintaining leading position in self-driving

Searching for Tesla or using Tesla's hands on YouTube, one can find that there are surprisingly many favorable reviews about autonomous driving. Tesla's self-driving technology is six years ahead of Toyota and Volkswagen, according to the article. However, the same article shows that it is easier to implant self-driving systems in cars without internal combustion engines and calculated the six-year technology gap based on the current technology of existing internal combustion engine automakers. Of course, it is not easy to keep up with advanced technology, but i believe that it is not impossible to catch up with Tesla's self-driving technology in a short period of time if they study self-driving systems in electric vehicles and collaborate with self-driving companies to develop self-driving technologies. That's why Tesla's share price is now considered highly valued.

+

Tesla is currently highly valued, and i've looked at the number one company in battery sales ( CATL in China).

It has already gone up a lot. And individual foreigners were not available for purchase.

But if i had to invest in the electric car sector, I would invest in the battery company rather than the electric car company.

++

Previous text

'투자 > 해외주식' 카테고리의 다른 글

| [주식잡담] 미국 시장 7%대 상승 (ft. 금 1700달러 돌파..) (2) | 2020.04.07 |

|---|---|

| 루이싱 커피 회계 부정 (ft. -75% , 스타벅스) (6) | 2020.04.03 |

| 테슬라(TSLA) 주가는 SEXY한가? (0) | 2020.02.22 |

| Should we buy Alibaba stocks? (0) | 2020.02.13 |

| 알리바바(Alibaba) 주식 매수해야 할까? (0) | 2020.02.09 |